Why Invest in Farmland

- Jan 31, 2023

- 3 min read

Updated: Feb 15, 2023

Farmland has a straightforward investment thesis that hasn’t been straightforward to invest in.

As a trillion dollar asset class with a long history of building wealth for generations, investments in farmland can add diversity to your portfolio with historically strong and low-volatile appreciation trends.

Here are the main components of the farmland investment thesis:

1. The availability of high quality farmland is declining every day:

Food demand is up and the supply of productive land, both in the U.S. and globally, is down, creating a supply - demand imbalance that we believe will persist and create long-term value in the asset class

2. Farmland has historically strong performance:

Farmland has increased 6% on average every year since 1940, moving in-line with the S&P with less volatility

Farmland investments are backed by a real asset with tangible value growth

3. During past recessions and periods of high inflation, farmland has enabled diversification:

Farmland can act as a hedge against inflation, as values have historically increased with inflation while showing low volatility relative to the market overall

With little correlation to stocks and bonds, including through past recessions, farmland can help to diversify your overall portfolio strategy (for example, farmland increased 12% in 2022 per the USDA, while the S&P declined 19%)

Farmland Capital by FBN is here because farmland carries a straightforward investment thesis that hasn’t been straightforward to invest in. Our thoughtful structure enables investment alongside farmers, creating shared incentives to build value together. Farmers continue to operate and invest in what they know best – their land – which creates opportunities for above market returns in the farmland asset class.

We aim to keep you updated on developments in the farmland asset class as you develop your investment thesis. Check out our latest news here.

1. Declining supply of high quality land

US farmers are responsible for feeding the world, and the high quality land on which that production relies, is decreasing every day. In the meantime, growing, ageing populations and wealthier consumers need more calories from that decreasing base of production.

Farmland Capital gives you access to some of the highest quality farmland possible, through our network of FBN member farmers. We believe the supply of high quality land is decreasing the fastest, and will be most in demand as time goes on.

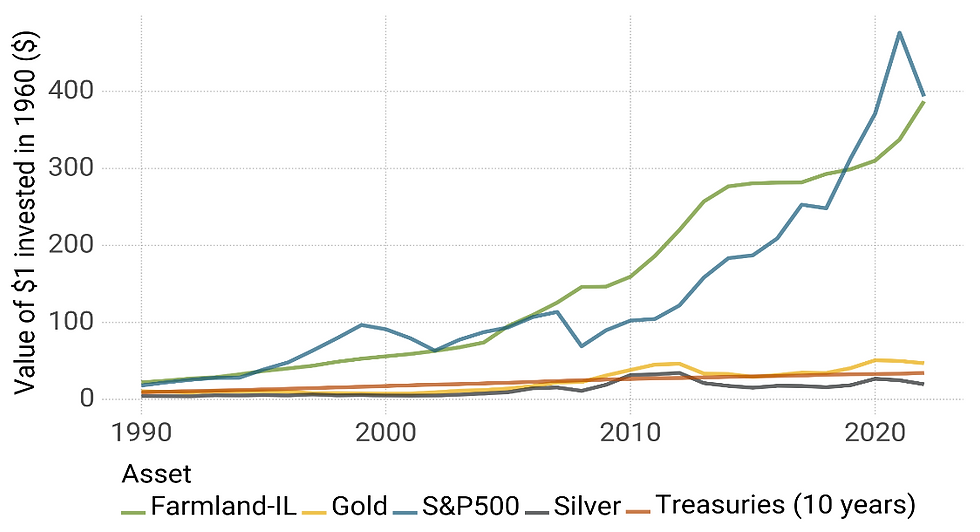

2. Historically strong appreciation

Farmland has held its value through all four of the most recent recessions, and appreciated at rates in-line with the S&P with less volatility.

Data from USDA (Farmland-IL), longtermtrends.net (Gold and SIlver), FRED St Louis (Treasuries), and Robert Shiller (S&P500).

All returns assume reinvestment of dividends

3. Portfolio diversification tool

In times of uncertainty, farmland can be a valuable tool to diversify your portfolio from traditional stock and bond investments, given its low correlation to these asset classes.

Sources:

Bonds: Moody's Seasoned Baa Corporate Bond Yield; S&P 500: S&P 500 index including dividends; Residential = 1940-1953 Five-CityMedian, 1953-1974 PHCPI, 1975-2019 S&P/CoreLogic/Case-Shiller; Commercial: FRED Commercial Real Estate Price Index; Farmland: USDA. Includes buildings and land

At FBN, we believe in farmland’s strong fundamentals:

an increasing demand for food as the available supply of land continues to decline,

strong historical appreciation, and

strength as a portfolio diversification tool

The growth in this asset class has created larger barriers to entry for new and veteran farmers to build their businesses, and underscores the importance of financing alternatives to help farmers buy land. Accredited investors like you are important to fulfilling our mission.

The blog contains very useful information. Thanks for sharing!

Visit our website: https://www.atdmoney.com/

Great overview! Farmland investing can offer long-term appreciation, act as a hedge against inflation, and help diversify a portfolio since its returns often aren’t closely tied to stocks or bonds. Plus, investing alongside farmers supports sustainable agriculture and rural land stewardship.

Farmland’s long-term value is driven by constrained supply, essential demand, and low correlation to traditional assets. As alex chen often emphasizes, assets grounded in real-world utility tend to outperform narratives over full market cycles.

This is a very informative post on Karnataka Pollution Control Board CTE and CTO requirements. Many businesses struggle with documentation and compliance timelines, so having clear guidance like this really helps. For companies looking for professional support, consulting experts such as Agile Regulatory can make the CTE/CTO approval process much smoother and faster. They help ensure proper compliance while avoiding unnecessary delays or rejections. Great insights shared here—keep up the good work!

Insightful article on the shift from SEO to GEO and how content must adapt to generative search engines. Your point about optimizing structure, context and user journey really hits the mark. At the same time, as teams evolve and scale through new systems and processes, it’s worth examining connectwise migration to ensure operations and support workflows remain smooth and aligned.